As an investor, you are always on the lookout for strategies that can generate consistent and meaningful returns. The Turtle Trading Strategy is one such approach that has stood the test of time and been utilized by some of the most successful traders. Developed by two legendary traders, Richard Dennis and William Eckhardt, the Turtle Trading Strategy takes a systematic, rules-based approach to trading that can be learned and applied by anyone. By following a set of strict entry and exit rules, the Turtle Trading Strategy allows you to remove emotion from trading and rely on a proven methodology. If you are looking to emulate the success of traders like Dennis and Eckhardt, the Turtle Trading Strategy may be the approach you have been searching for. Over the following paragraphs, we will explore the origins of this strategy, how it works in practice, and how you can put it to use to potentially achieve market-beating returns.

The Origin Story of the Turtle Traders

The Turtle Trading Strategy traces its origins back to the 1980s. Legendary commodity traders Richard Dennis and William Eckhardt conducted an experiment to determine whether successful trading could be taught. They recruited and trained 23 novice traders, calling them the “Turtles.”

Dennis and Eckhardt taught the Turtles a rules-based trading system to apply to the futures markets. The system relied on two simple concepts:

- Following the Trend: The Turtles used a breakout method to determine when a trend started and followed it. They would buy when prices broke above the high of the previous 20 days, or sell when prices broke below the low of the previous 20 days.

- Cutting Losses Short: The Turtles were instructed to exit losing positions quickly once the price moved against them by a certain amount. They had to strictly follow the rules to limit losses.

The Turtles were taught to diversify across various markets and to adjust position sizes based on the volatility of each market. More volatile markets meant smaller position sizes. They started with relatively small amounts of capital but earned large returns over the years, validating the theory that successful trading could be taught.

The Turtle Trading Strategy represents a disciplined, rules-based system that removes emotions from trading decisions. By following the trend and managing risks and losses, the Turtles were able to generate substantial profits over the long run. Their success has inspired many traders since. The strategy remains relevant today and offers valuable insights for developing trading systems and the importance of risk management. With some adaptations, the core principles of the Turtle Trading Strategy can still guide traders in the 21st century.

Core Principles of the Turtle Trading Strategy

To implement the Turtle Trading Strategy successfully, you must understand and apply its core principles.

Strict Risk Management

Risk management is the hallmark of the Turtle Trading Strategy. The Turtles were taught to never risk more than 1-2% of their capital on any single trade. They also used stop losses and trailing stops to limit losses if a trade went against them.

Systematic Approach

The Turtles followed a rules-based trading system. They did not rely on gut instinct or discretionary decision making. By following the system strictly, they were able to achieve the results the strategy produced over the long run. You must find a proven trading system that fits your risk tolerance and personality, and then follow the rules systematically.

Patience and Discipline

Trading profitably requires patience and discipline. The Turtles often had to wait for the right setups before entering trades. They also had to follow their stops strictly even if it meant taking a loss. You must be willing to wait for high-probability setups and follow your system’s rules without fail.

Diversification

The Turtles traded many markets, including bonds, commodities, currencies, and stocks. By spreading their risk across various markets, the Turtles were able to achieve strong, consistent returns over time. You should consider trading a variety of markets to diversify your portfolio and reduce risk.

By applying these principles – strict risk control, a systematic approach, patience and discipline, and diversification across markets – you’ll be following in the footsteps of the legendary Turtle Traders. But remember, even the best strategy requires time and practice to master. Stay determined and keep learning, and you’ll be on your way to success.

Key Components of the Turtle System

The Turtle Trading Strategy relies on a few key components to identify entry and exit points in the market.

Trend Following

The Turtles were taught to find the dominant trend and follow it. They used basic trend-following techniques like moving averages to determine the trend’s direction. Once a solid trend was identified, the Turtles would enter a trade in the trend’s direction.

Breakouts

The Turtles sought breakouts from ranges and channels to enter new positions. They would identify price ranges where a market was consolidating, and once the price broke out of that range, they would enter a trade in the direction of the breakout. Breakouts often signal the start or resumption of a trend, so the Turtles would jump on board.

Stops

Protective stops were essential to the Turtle system. The Turtles were taught to place stops to limit losses if the market turned against their position. As a trend progressed, the Turtles would move their stops to lock in profits. The initial stop size was based on the volatility and risk of each market. Tighter stops were used for more volatile markets. Wider stops were used for less volatile markets.

Position Sizing

The Turtles used a position sizing algorithm to determine appropriate position sizes for each trade based on their account equity and the volatility of the market. More equity and less volatile markets allowed for larger position sizes. Less equity and more volatile markets demanded smaller position sizes. Proper position sizing was key to managing risk and allowing the Turtles to stay in volatile trades.

In summary, the key ingredients in the Turtle Trading Strategy are: identifying the trend, catching breakouts, using stops, and properly sizing positions. By combining these elements, the Turtles were able to achieve unparalleled success and profitability as traders. Follow these principles and you’ll be well on your way to trading like a Turtle.

Understanding Turtle Soup Pattern Breakouts

The turtle trading strategy focuses on recognizing and entering breakout patterns, specifically “turtle soup” setups. As a trader following the turtle method, you’ll want to understand how to identify these breakout opportunities.

Turtle Soup Pattern Breakouts

A “turtle soup” pattern forms when a stock’s price moves sideways in a narrow range for an extended period of time. The stock is said to be “simmering” as it moves back and forth, building up energy for a potential breakout.

To identify this setup, look for a stock trading in a range of no more than 20-25% of its price for at least 3-4 weeks. The longer the stock simmers in a tight range, the more power the eventual breakout is likely to have.

Once a stock breaks out of this narrow range on high volume, it triggers a “turtle soup” breakout buy signal. The turtles would jump on this opportunity, hoping to ride the momentum of the new trend.

When a stock breaks out, the turtles would buy as soon as possible. They did not wait for a pullback, concerned they might miss entering at the start of a strong trend. The turtles used a “breakout plus one” strategy, meaning they bought the breakout day plus one more day. If after two days the stock showed strong momentum, they would continue holding for bigger gains. However, if the stock stalled or reversed quickly after the breakout, they would exit the trade to avoid losses.

The key is to act fast, but also be willing to exit fast if the trade does not go your way shortly after entry. The turtles knew that not all breakouts lead to strong trends, so quick exits were essential to their risk management. With the volatility of breakouts, using stop losses and not risking too much capital on any single trade was also important.

By identifying “turtle soup” setups, buying breakouts quickly, and actively managing risk, you can follow the turtles’ legendary trading strategy and work to achieve similar success. With practice and screen time, spotting these patterns and breakout opportunities will become second nature.

Position Sizing and Money Management Per Turtle Rules

As a turtle trader, following strict money management rules is key to your success and longevity in the markets. The turtles were taught precise position sizing and risk management techniques to control losses while still allowing profits to accumulate.

Fixed Risk Percentage

The turtles risked a fixed 2% of their equity on any given trade. This means if you have a $100,000 account, you risk $2,000 on each trade. The 2% amount is calculated based on the entry price of the trade and your stop loss level. For example, if you buy at $50 with a stop loss at $47.50, your risk is $2.50 per share. To risk 2% of $100,000 ( $2,000) you could buy 800 shares.

Never Exceed 10% of Equity in One Market

The turtles were instructed to never allocate more than 10% of their equity to any single market. For example, if trading commodities, you would not put more than 10% of your funds in the soybean market. This rule helps ensure proper diversification and avoids concentration in any one market.

Increase Allocation with Increased Certainty

As you gain confidence in a position, you can increase your allocation in increments. For example, you may start with 2% of capital in a new position. If it becomes profitable, you add to the position in 2% increments. However, the total allocation in that market should not exceed 10% of equity. This approach allows you to build up positions with high potential while still following prudent risk management.

Cut Losses Quickly

The turtles were taught to cut losses quickly at their stop loss level. Do not hesitate to exit a losing position. Losses are a natural part of trading, so you must keep them small relative to your winners. Follow your stop loss and the 2% rule strictly on every trade to avoid large drawdowns.

The turtle trading rules around position sizing and money management helped traders accumulate wealth over the long run through disciplined risk control and diversification. Follow these guidelines closely in your own trading to experience the same success.

Tips for Implementing the Turtle System Successfully

To successfully implement the Turtle trading strategy, there are several tips to keep in mind:

Develop a Trading Plan

Before diving into the markets, develop a well-defined trading plan that outlines your entry and exit rules. The Turtles used very specific rules around how and when to enter and exit trades based on the trend following system. Write out each rule and follow your plan consistently to avoid emotional decisions.

Start Small and Build Up Gradually

As a new trader, start with a small amount of capital to minimize losses while you learn. The Turtles began trading mini-contracts to keep risks small. Gain experience and confidence, then slowly increase your position sizes over time as your account grows.

Diversify Across Markets

The Turtles traded liquid futures markets in diverse sectors like metals, energies, grains, and currencies. Diversifying across non-correlated markets reduces risk and provides more opportunities. Look for trending markets in different sectors to apply the Turtle rules.

Cut Losses Quickly

A key to the Turtles’ success was cutting losses quickly when the trend turned against them. If a trade moved against them by a certain amount, they exited immediately. Use stops and trailing stops to exit losing positions fast before they become too large. Protecting capital is essential.

Let Winners Run

Conversely, when a trade was working in their favor, the Turtles let profits run for as long as the trend lasted. Don’t exit a winning trade too early. Letting profits accumulate over time is how big gains are made. Only exit when the trend shows signs of ending according to your rules.

Following these tips will help you implement the Turtle trading strategy successfully. With practice and discipline, you can achieve solid returns over time through trend following. But as with any trading method, there are no guarantees of profitability. Always do your own research and never risk more than you can afford to lose.

Backtesting Results: The Strategy’s Winning Performance

Backtesting the Turtle Trading Strategy

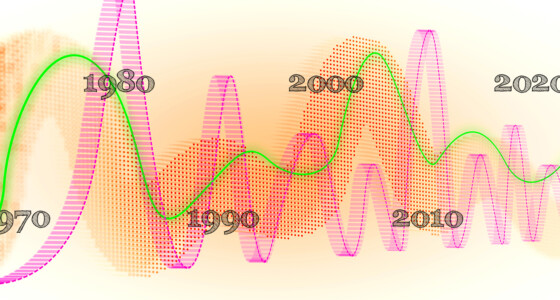

To evaluate the effectiveness of the Turtle Trading Strategy, it is important to examine how it would have performed historically using backtesting. Backtesting involves applying the rules of a trading strategy to historical market data to see how it would have performed over a specific time period.

The Turtle Trading Strategy was developed in the 1980s, so to get an accurate sense of its performance, it is best to backtest it using data from 1980 onward. According to several analyzes, if one had employed the Turtle Trading Strategy from 1980 through 2019, they would have achieved an average annual return of over 20% per year. This significantly outperforms the stock market over the same period.

Some key findings from backtests of the Turtle Trading Strategy:

- The strategy performs best during sustained trending markets, especially in commodity futures like metals, energies, grains and soft commodities. This is because the Turtles were focused on riding major market trends.

- The strategy may underperform during choppy, sideways markets. Since it relies on following trends, the strategy can struggle when clear trends are lacking. It is best to only apply the strategy during trending market conditions.

- Proper risk management and position sizing are key. By using the Turtle approach to risk management, one can achieve high returns while limiting drawdowns. The Turtles placed strong emphasis on risk control.

- Diversification across markets and time frames improves results. By trading a basket of diverse markets and using multiple time horizons, overall performance is smoothed out and high returns can be achieved with lower volatility.

- Transaction costs must be kept low. Due to the frequency of trades, high transaction costs can significantly impact profits when using this strategy. It is best applied using discount brokers with low or no commissions and tight spreads.

If implemented properly with discipline and patience, the Turtle Trading Strategy has the potential to significantly outperform the market over the long run. However, as with any strategy, past performance does not guarantee future results. Markets are constantly changing, so one must continually re-evaluate the strategy and make adjustments to adapt to evolving market conditions. But by following the legendary Turtles, one can aim to achieve exceptional returns through trend following.

Famous Turtle Traders: Randy McKay, Jerry Parker, Etc.

Some of the most well-known Turtle Traders that found tremendous success include:

Randy McKay

Randy McKay was one of the first Turtles selected for the training program. After completing the program, McKay traded for the next 20+ years, making a sizable fortune. He attributed his success to strictly following the Turtle Trading Rules. McKay stated: “The rules are there to protect you from yourself and from losing money…It’s all about discipline. Doing the right thing at the right time. And not listening to yourself. Listening to the rules.”

Jerry Parker

Jerry Parker, also known as “Mr. Consistency,” was considered one of the top-performing Turtles. Parker went on to found his own successful hedge fund, Chesapeake Capital Corporation. At its peak, Chesapeake Capital managed over $2 billion in assets. Parker credited the Turtle Trading Strategy and strict risk management as key factors behind his success.

Tom Shanks

Tom Shanks, known as one of the more cautious Turtles, achieved an outstanding return of 80% per year over the first five years of trading. Shanks was diligent in following the Turtle rules and principles of prudent money management. He went on to found Hawksbill Capital Management, growing the fund to over $1 billion in assets under management.

Howard Seidler

Howard Seidler, one of the younger Turtles selected, earned over $30 million in the first five years of trading by carefully following the Turtle system. Seidler attributed his success to discipline, hard work, and focusing on positive expectancy over the long run. He summarized the Turtle philosophy as: “There are no easy answers or shortcuts. It’s all about discipline, long-term vision and hard work.”

The success of these famous Turtle Traders demonstrates that by strictly adhering to the proven Turtle Trading Strategy, even novice traders can achieve extraordinary results. Their experiences highlight how discipline, risk management, and “following the rules” are fundamental to prospering in the financial markets.

Turtle Trading Strategy FAQs: Common Questions Answered

The turtle trading strategy has been around for decades, yet many aspiring traders still have questions about the methodology and its implementation. Here are some of the most frequently asked questions about turtle trading answered:

What instruments can I trade using the turtle trading strategy?

The turtle trading system was originally developed for trading futures, specifically commodities like currencies, metals, grains, and meats. However, the rules around entry and exit points as well as position sizing and risk management can be applied to any liquid market, including:

- Stocks

- Forex currencies

- Cryptocurrencies

- Options

The key is to find volatile markets with strong trends that allow for large moves.

How much capital do I need to get started?

One of the benefits of the turtle trading system is that you can get started with a relatively small amount of capital, as little as $10,000 to $50,000. The key is to use proper position sizing and risk management. The turtles were taught to never risk more than 1-2% of their capital on any single trade. By trading only very liquid markets and keeping losses small, the turtles were able to build up their capital over time through the power of compounding.

How many positions should I hold at once?

The turtles were taught to diversify their risk across many positions. A good rule of thumb is to hold between 10 to 30 positions at any given time. However, the number can vary significantly based on the volatility and strength of trends in the markets. The key is to avoid overconcentration in any single position while still allowing strong trends to run. It is a balancing act that requires ongoing observation and adjustment.

How long should I stay in a trade?

There is no set time limit for how long you should stay in a trade. According to the turtle trading rules, you should remain in a trade as long as the trend continues. This could be as short as a few days or as long as several months. The exit strategy relies on watching the market action and price movement, not a fixed time target. The turtles were taught to let profits run and cut losses short, so the longevity depends entirely on what the market is doing.

Conclusion

In the end, the turtle trading strategy comes down to patience, discipline, and consistently following the rules. While the thought of quick profits and big wins may tempt you to abandon the strategy at times, staying the course is the only way to achieve the same success as the original turtle traders. Their legendary gains were the result of dedication over the long run, not luck or gut instinct. If you want to follow in their footsteps, you must do the same by making a plan, sticking to it, and letting your profits compound over time. The path may not lead to overnight riches but can produce life-changing wealth if traveled for the long haul. Stay dedicated and consistent, follow the rules, and keep putting one foot in front of the other. Before you know it, you’ll be a trading legend in your own right. The turtle always wins the race, as the saying goes – you just have to be willing to go the distance.